what were the monetary and fiscal policy responses to the Great Recession

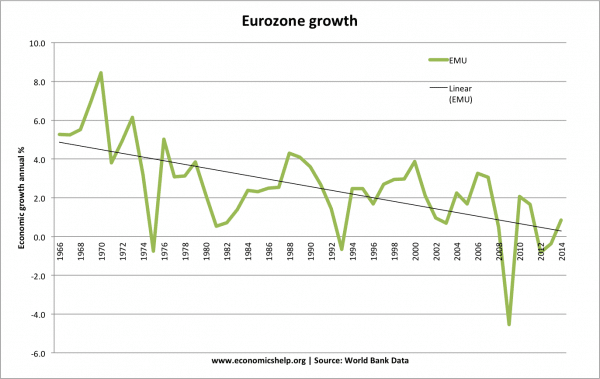

The peachy recession refers to the economic downturn between 2008 and 2013. The recession began after the 2007/08 global credit crisis and led to a prolonged menstruum of low/negative growth, rising unemployment and a menstruum of fiscal thrift. In item, the great recession highlighted issues within the Eurozone which experienced a double-dip recession and high unemployment.

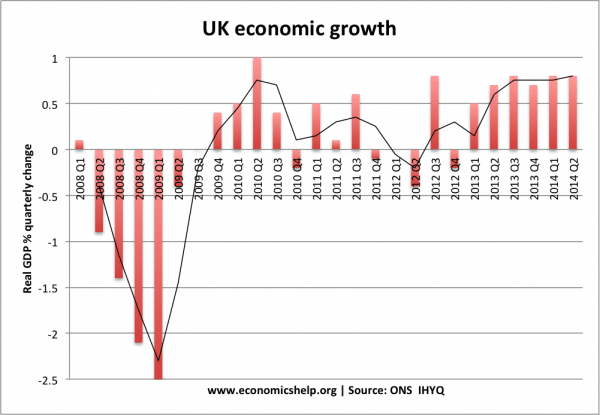

Recession in US and European union. Source: Eurostat

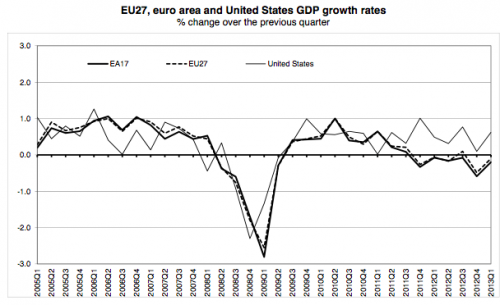

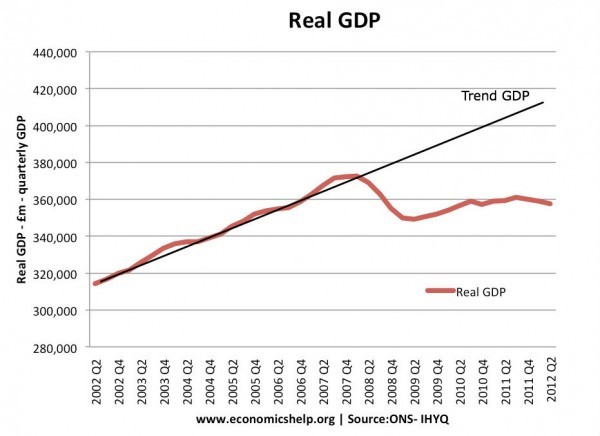

Output gap

Graph showing how much existent Gross domestic product cruel behind the trend growth in the UK. Unlike previous recessions, the economic system did not catch up the lost output.

Causes of the slap-up recession 2007-08

The primary cause of the great recession was the credit crunch (2007-08) where the global banking organisation became short of funds, leading to a decline in conviction and decline in banking company lending. The causes of the credit crisis were quite complicated just in summary.

- In 2000-2007, U.s.a. banks made a big increment in sub-prime number mortgage loans. These mortgages were very risky, but there was a adept bargain of 'irrational exuberance' and belief firm prices would keep rising.

- Usa mortgage companies sold these 'risky mortgage bundles' on to banks around the world. (Credit rating agencies gave them AAA ratings – despite the fact they were very risky.)

- Starting around 2005, US interest rates rose, and homeowners in the Us began to default on these risky mortgages.

- US banks lost money, only also banks around the world later realised the 'safe' mortgage bundles they bought were actually useless. Then many banks around the world saw a big fall in liquidity and value of their assets.

See more at: Credit crunch for a more detailed business relationship

The recession was also caused by

- Credit crisis led to a autumn in bank lending, due to a shortage of liquidity.

- Autumn in consumer and business confidence resulting from the financial instability.

- Fall in exports from the global recession.

- Fall in firm prices leading to negative wealth furnishings.

- Fiscal thrift compounded the initial autumn in Gross domestic product.

- In Europe, the single currency created boosted problems because of over-valued exchange rates, and high bond yields.

More details on causes of peachy recession

- Great Moderation. The period 2000-2007 was a fourth dimension of stiff economic growth, depression inflation and falling unemployment. Central Banks appeared to be successful in targeting low inflation and ensuring economic stability. However, underneath the macro-economical stability, there was growing instability regarding credit and fiscal markets.

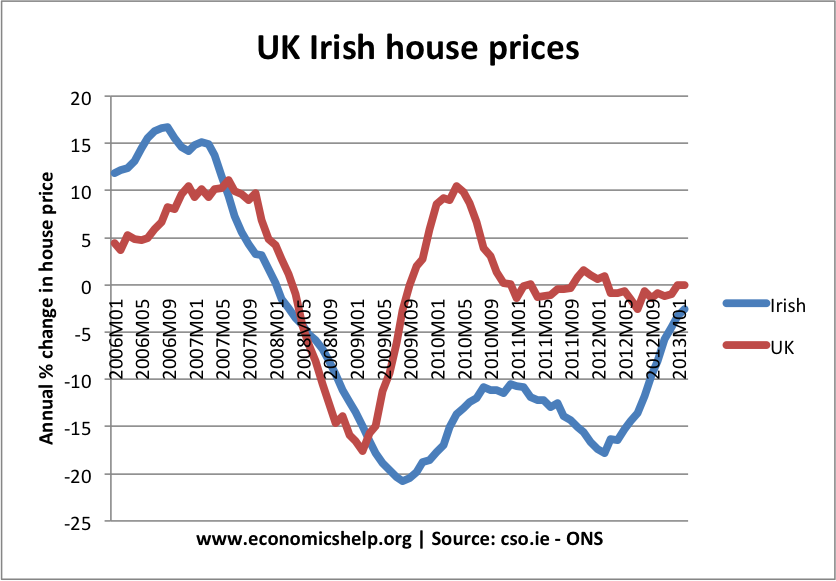

- Housing bubble. Many countries experienced a rapid growth in firm prices. House price rose faster than inflation and faster than incomes. This boom in housing was encouraged by a growth in bank lending and high conviction. Several countries, such as Ireland and Espana also experienced a boom in house building.

Irish and UK housing cost fall in 2008.

Irish and UK housing cost fall in 2008. - Bad loans. In the period leading up to the credit crunch, banks became more ambitious and willing to take risks in lending. Particularly in America, banks and mortgage companies loosened their criteria for giving mortgages. Many homeowners were given large mortgages, with limited checks on their ability to repay. However, in the economic downturn, people were left with mortgages they couldn't afford.

- Bad loans repacked and resold. These 'bad' mortgage loans were sold onto other financial institutions around the world. For example, many U.k. and European banks bought these mortgage bundles from the US (CDOs) and and then were exposed to any potential losses in the United states housing market.

- Housing Bubble Flare-up. In 2006, the US housing market chimera flare-up. Business firm prices started to fall, and in that location was a rise in mortgage defaults. Banks began to realise they had lost significant sums of money through the US mortgage defaults.

- Banks brusque of liquidity. The calibration of bank losses started to increment and it became harder for banks to infringe coin on money markets. This caused banks to reduce loans and mortgages. Considering banks were losing coin, it became challenging to get credit and liquidity. Some banks lost and so much they were running out of money. In several countries, such every bit U.k., Ireland and U.s.a., major banks had to be bailed out by the authorities. But, the realisation banks were short of liquidity harmed consumer and investor confidence. The fall in confidence led to lower spending and investment.

- Rise in oil prices. In 2008, there was also a peak in oil prices. This complicated matters because it acquired cost-push inflation. This cost-push inflation made Key Banks more than reluctant to cutting interest rates. Also, college oil prices reduced discretionary income and led to lower spending. Usually, in a recession, oil prices fall. However, because of ascent need in Communist china and India, we saw ascent oil prices – even as Europe and the Usa went into recession. High oil and article prices was another gene reducing need.

The bear on of the credit crunch and recession

- In 2008, all major economies experienced a very abrupt drop in real GDP. The banking crunch severely curtailed normal bank lending. The result was a fall in investment and consumer spending leading to a abrupt drib in real Gross domestic product.

- The fall in business firm prices was another factor leading to recession. In the boom years, rising house prices (and wealth) underpinned higher consumer spending. When house prices dropped, many homeowners faced negative equity. Therefore, they cut dorsum on spending and could no longer rely on re-mortgaging to gain equity withdrawal.

- The global nature of the crisis meant that there was as well a drop in world trade. Countries saw a drop in exports every bit the global downturn led to lower demand.

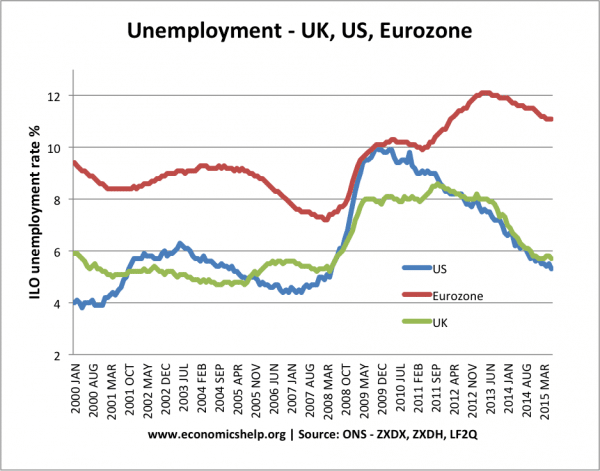

- Unemployment. Unemployment rose in US and Eurozone.

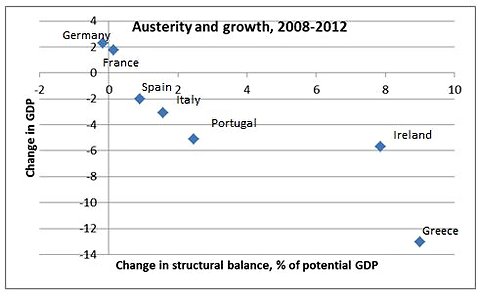

- Government debt. Government debt rose sharply due to the recession. This ushered in a period of 'austerity' with many governments in Europe seeking to cut spending.

- Euro crisis. The Eurozone saw a rising in bond yields in 2010-12 – partly due to recession, and besides due to lack of Primal Bank willing to intervene.

Response to the great recession

- Bank rescues. Firstly, governments felt obliged to intervene in the banking sector to avoid banks and financial institutions going bust. Still, there was some reluctance to bailout those who were blamed for causing the crunch. In 2008, the US decided to allow Lehman Brothers to go bust. This caused a major loss of confidence. After the panic this created, governments realised they couldn't permit a repeat of this experience. In the UK, the government intervened to bailout out major banks, such every bit Northern Rock, and Lloyds TSB.

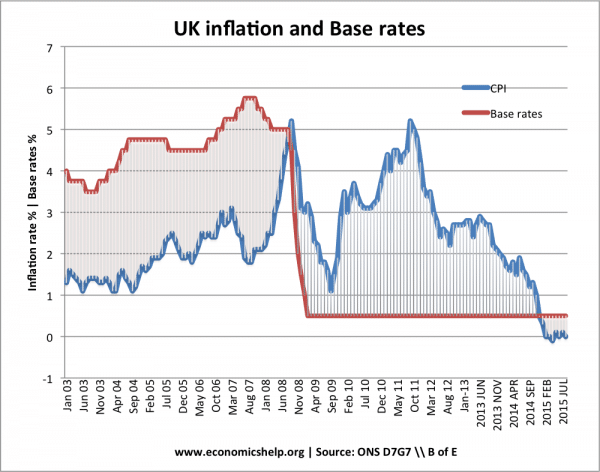

- Cuts in involvement rates. Towards the latter half of 2008 and early 2009, Central Banks cut interest rates to record depression levels. The UK cut base of operations rates from 5% to 0.v%. Usually, a major cut in involvement rates would make borrowing cheaper and encourage consumption and investment. (e.g. in 1992, when the Uk cutting involvement rates, the economic system recovered fairly quickly.) Even so, cuts in interest rates were less effective in this catamenia.

- Expansionary fiscal policy. The deep recession saw a sharp rise in budget deficits because government taxation revenues evaporated. This was particularly noticeable for countries who relied on stamp duty and tax from the finance sector. Nonetheless, in the Britain and US, there was a moderate degree of fiscal expansion. The UK introduced a temporary cutting in VAT. In the US, there was besides a moderate financial stimulus.

- It is worth noting that in comparison to the groovy low of the 1930s, two things were avoided in the great recession.

- Big number of banks going broke was avoided (In the 1930s, in the Usa over 500 commercial banks went bankrupt)

- At that place was no major trade war. In the 1930s, a tariff war developed every bit countries tried to protect domestic industries.

Why did normal policy fail to achieve a proper economic recovery?

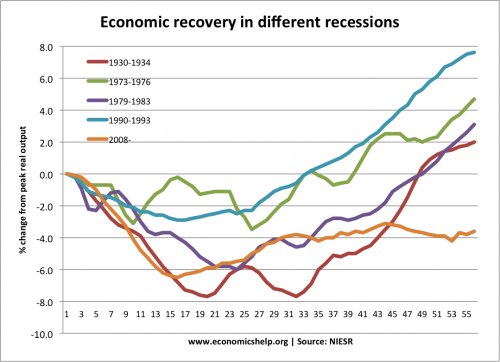

The Uk had the slowest recovery on record. See: Comparing dissimilar recessions

- Balance canvass recession. Firstly, the recession was very deep. Considering firms, banks and consumers were highly indebted, they decided they needed to pay downwards debt. Therefore, this led to a significant fall in spending as they full-bodied on paying off debt. In the Great britain, the saving rate rose from 0% to 7% in a brusque space of time. This tin be referred to as a balance sheet recession.

- Shortage of credit. Lower base of operations rates didn't increment bank lending. Although Central banks cutting interest rates, this didn't interpret into higher lending and investment. (an example of a liquidity trap)

- Commercial banks didn't pass these interest rate cuts onto their consumers. Especially in the Eurozone periphery banking company rates didn't autumn. In the UK, bank rates fell, but less than the cut in base rates. (banking company and base of operations rates)

- Credit remained tight. Although credit was, in theory, inexpensive, information technology was difficult to get any loan. Banks were short of greenbacks and so discouraged lending. It became very difficult to get a mortgage, and then demand for housing remained low.

- Eurozone crisis. In Europe, the crisis highlighted the fact that the Greek public sector debt was much higher than previously thought. Before 2007, bond yields in the Eurozone had been very low. Just, afterwards the credit crisis and realising the true levels of Greek debt, bond yields in Europe rose rapidly. People became nervous about property Eurozone bonds. The ascension in EU bail yields created a new panic. European governments felt the necessity of cutting budget deficits ('austerity'). This involved cut government spending and higher taxes. However, in a recession, this fiscal austerity led to lower aggregate demand and worsened the recession. Encounter more at Euro debt crisis

- Productivity crisis. The UK economic system experienced unexpectedly depression productivity growth (2007-2017). This was due to various reasons – low wage growth, flexible labour markets, express technological innovation and investment. It suggests there is a autumn in the underlying trend charge per unit of economic growth.

Investment problems specific to the Eurozone

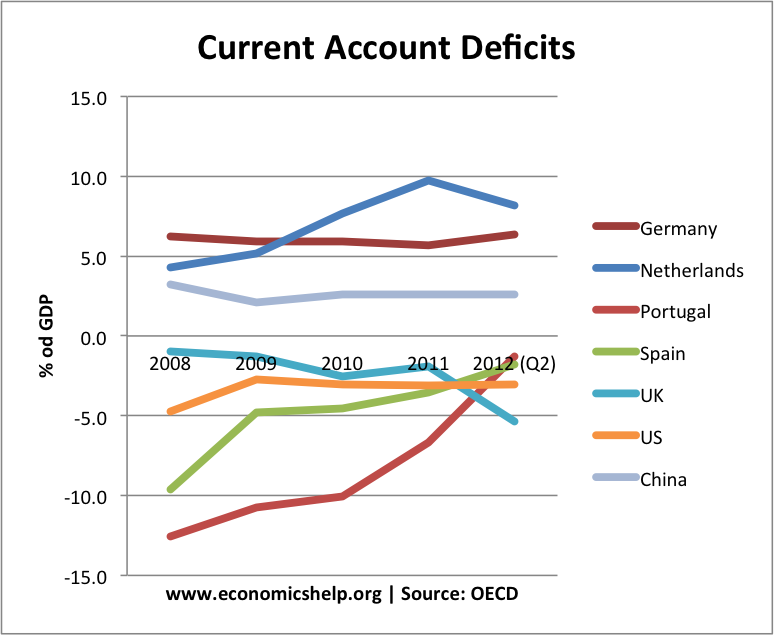

- In the lead upwardly to the recession, Europe experienced a trade imbalance. Germany and some northern countries ran a big current account surplus. (The U.k. and US too had large electric current account deficit, suggesting an imbalanced economic system)

- Countries in the south, such as Portugal, Spain and Greece ran a very large current business relationship deficit. This meant the s was uncompetitive, leading to lower exports. Afterwards the crisis, these countries needed to restore competitiveness through internal devaluation – essentially lower wages. This acquired lower demand and lower growth.

- No Primal Bank. In the UK and U.s., bond yields roughshod during the crunch. With their own currency, they accept a Fundamental Depository financial institution willing to arbitrate and buy bonds if necessary, this avoids any liquidity shortages. But, in the Eurozone, this didn't occur (at least non until late 2012). Therefore, bond yields rose, and countries felt a need to cutting upkeep deficits apace. The UK and US only pursued very moderate austerity in 2011/12. But, some countries in Europe, cut authorities spending very significantly.

- Fiscal austerity. Combined with falling individual sector spending, government spending cuts caused amass need to fall sharply.

- Weak monetary policy. The ECB is responsible for the whole Eurozone and is unable to target higher growth in depressed areas. The Great britain and Usa adopted quantitative easing, but the ECB is much more reluctant.

- Housing markets vulnerable. Countries like Spain and Ireland saw a boom in house building, which created a large surplus of housing. This has meant the fall in firm prices was more than sustained than say the Great britain.

- Unemployment. In southern European, countries similar Kingdom of spain, Greece and Portugal take experienced depression-level unemployment and falls in Gross domestic product. In Espana, Greece and Portugal, unemployment is close or above 20%. Youth unemployment is even higher.

The charge per unit of unemployment fell quicker in the U.s. and Great britain than the Eurozone. The higher unemployment in Eurozone was due to greater financial thrift and lower economic growth. Information technology has also been attributed to less flexible labour markets.

The UK in the great recession

The initial recession hit the Uk difficult because of our relative reliance on the finance sector. The drop in Gdp was longer-lasting than in the 1930s.

Despite, cuts in interest rates and big sums of quantitative easing, the UK economy stalled in 2011 and went into a double-dip recession. Some felt that the government's austerity drive of 2010-12 was a significant cistron in causing this double-dip recession. Although spending cuts were relatively mild, there was also an agin impact on confidence. Nevertheless, unemployment rose less than might accept been expected (UK unemployment mystery) Most economists feel that the United kingdom of great britain and northern ireland experience would accept been worse, had we been a fellow member of the Euro.

- Bond yields would take been higher. No Central Bank to act as lender of last resort.

- There may take been pressure for much deeper austerity.

- We couldn't take benefited from twenty% devaluation in Pound.

- Interest rates would have fallen more than slowly.

- Less scope for quantitative easing and funding for lending scheme.

However, the UK economic system is even so reliant on exports to Europe and a continued Eu recession is a factor in slowing UK growth.

Encounter: Economic tape of UK 2010-16

Related

- Economical history

Source: https://www.economicshelp.org/blog/7501/economics/the-great-recession/

0 Response to "what were the monetary and fiscal policy responses to the Great Recession"

Post a Comment